COVID-19 Alert: Paycheck Protection Program

Your farm may be eligible for short-term federal loan programs through the Small Business Administration (SBA).

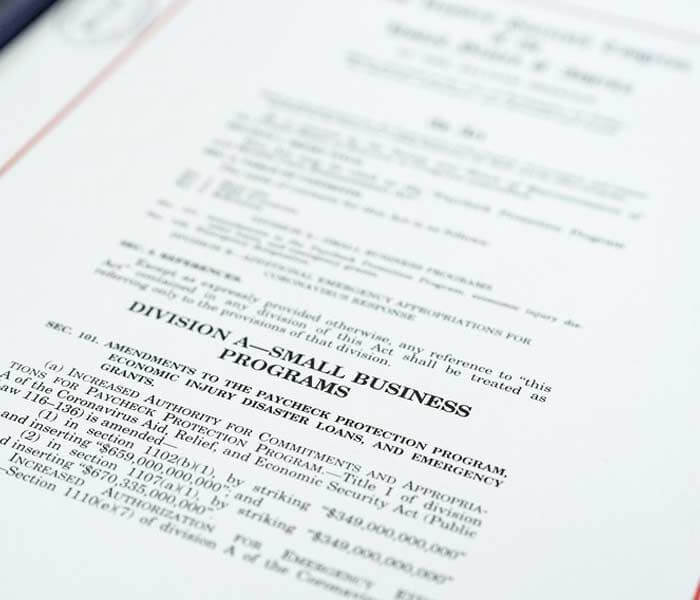

In the two most recent legislative coronavirus relief packages, Congress created the Paycheck Protection Program (PPP) and broadened eligibility for the Economic Injury Disaster Loans (EIDL) administered by the Small Business Administration. Congress has confirmed that farms are eligible for both programs.

After the initial funds have run out in mid-April, Congress added billions more to each program in late April. Enrollment has already reopened so farms should still contact their financial institutions to discuss potential benefits if they have not done so already. For PPP loans, farms and businesses need to apply through a financial institution. For EIDL loans, farms and businesses apply directly to SBA online.

Here are the basics:

Paycheck Protection Program

PPP offers farms and small businesses short-term, low-interest loans to cover payroll costs, mortgage interest, rent and utilities. Loan funds used for those specific items are eligible to be forgiven if employee count and compensation are not reduced. No more than 25 percent of the forgiveness amount may be attributable to non-payroll costs.

Loan terms will be 1 percent interest and mature in two years, with payments being deferred for six months and interest accruing during that time. Amounts forgiven will not be counted as income by the lender.

Individual loan amounts are calculated according to the following steps:

-

Aggregate payroll costs from the past 12 months for employees whose principal place of residence is the U.S.*

-

Subtract any compensation paid to an employee who is compensated more than $100,000 a year.

-

Divide aggregate payroll costs from Step 1 by 12 to determine your average monthly payroll costs.

-

Multiply the average payroll costs by 2.5.

You can find additional information on the SBA’s PPP website and by contacting your financial institution to complete your application.

Emergency Economic Injury Disaster grants and loans

In addition to allocating more money to the EIDL program, the legislation allows farms and other agricultural enterprises to enroll. This change means farms would be able to apply for low-interest loans and qualify for $10,000 emergency grants.

To be eligible, a business must show economic harm as a result of the crisis. Grants are limited to $1,000 per employee with a maximum of $10,000. Loans to help overcome loss of revenue may be used to pay fixed debts, payroll and other like costs. The maximum loan is $2 million and the loans are subject to certain limitations. You can find out more information and directly apply on the SBA website.

**Fund availability and program rules subject to change.**

Aaron Stauffacher

Associate Director of Government Affairs, Dairy Business Assiciation, Edge Dairy Farmer Cooperative