Palmitic Acid Sensitivity Analysis

This sensitivity analysis considers the portion of palmitic acid fed as a dietary supplement that ends up as butterfat and energy for body utilization. It assumes that:

- A portion of the palmitic acid fed ends up in milk fat with a transfer efficiency declining as supplemented fat levels are increased (based on a summary of 12 studies feeding palmitic acid).

- The pool of absorbed palmitic acid not incorporated in milk fat ends up being used in the body as an energy source. An average economic value of NEL was used based on a Sesame analysis of nutrient costs (averaged across US at US$ 0.12/Mcal of NEL).

- This analysis considers an average herd feeding a one group TMR. Fat response varies by lactation stage, parity, and level of production. These factors are not incorporated in this analysis. We can give a more precise recommendation if provided with more details of the herd and the goals to be accomplished.

- Other nutrition and management factors do affect butterfat production. Potential interactions between these factors and fat supplementation are not accounted for in this analysis.

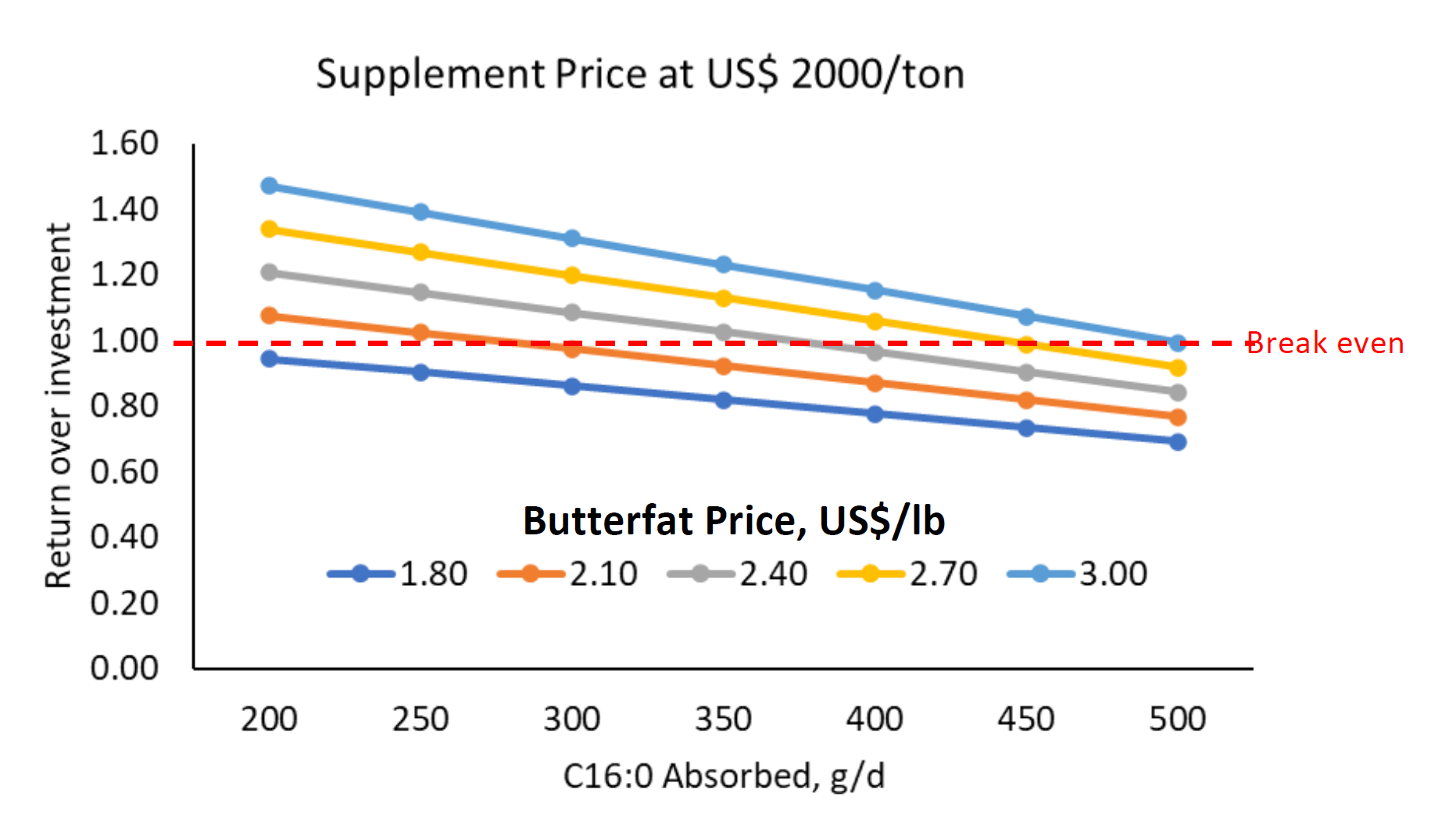

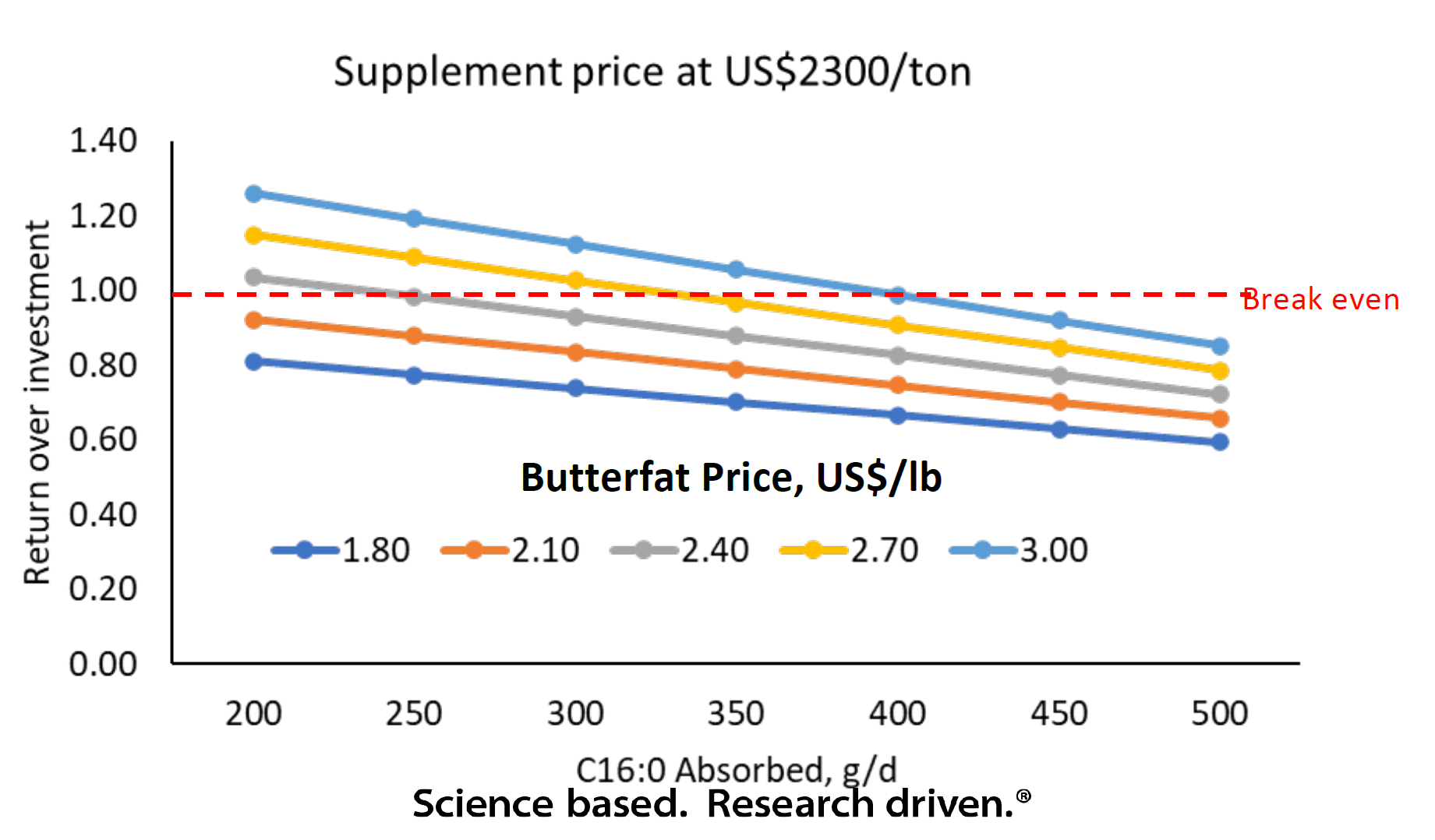

- Fat supplement prices are trending higher. Average prices across the US are currently hovering around US$ 2000/ton for palmitic acid-enriched supplements. We estimated return over investment (ROI) for additional palmitic acid fed considering palmitic acid supplement prices at either US$ 2,000 or US$ 2,300/ton.

- We considered the digestibility of the palmitic acid supplements when determining the response to absorbed palmitic acid because the digestibility across different supplements varies and is an important factor. Please check the digestibility of a given supplement with its supplier. Digestibility values in most current nutrition softwares are generally not up to date.

- Because of the upward trend in butterfat price and its volatility, we considered butterfat prices varying from U$$ 1.80 to 3.00/lb.

- The 2 graphs below are the results of ROI calculation with the assumptions described above.

Jonas De Souze

Perdue Agribusiness